Ever wonder how interest rates are set or why money seems “tight” or “loose”? The answers lie largely with the Federal Reserve (the Fed), the central bank of the United States. The Fed uses monetary policy—actions taken to manage the money supply and credit conditions—to promote maximum employment and stable prices. This post dives into the four key tools the Fed uses to achieve these goals, offering a glimpse into the mechanics of economic control.

Why Does the Fed Exist?

Before diving into the tools, it’s essential to understand the Fed’s mission. Its mandate is twofold:

- Maximum Employment: Promoting conditions that support job creation and minimize unemployment.

- Stable Prices: Keeping inflation in check to preserve the purchasing power of the dollar.

To achieve these goals, the Fed uses monetary policy, which involves managing the money supply and credit conditions.

The Four Pillars of Monetary Policy

The Fed employs four primary tools to influence the economy:

1. Reserve Requirements: The Foundation of Lending

Imagine banks as intermediaries between savers and borrowers. They accept deposits and then lend a portion of that money to individuals and businesses. However, they can’t lend out every single dollar. The Fed mandates that banks hold a certain percentage of their deposits in reserve, either in their vaults or at the Federal Reserve. This percentage is known as the reserve requirement.

- Raising the reserve requirement: This forces banks to hold more money in reserve, reducing the amount available for lending. This can slow down economic activity by making it harder and more expensive to get loans.

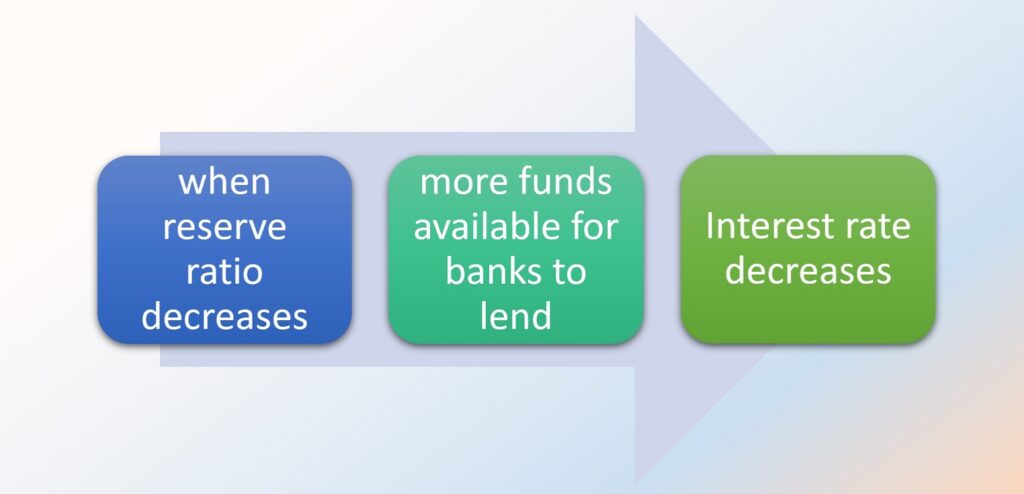

- Lowering the reserve requirement: This frees up funds for banks to lend, potentially stimulating the economy by increasing the availability of credit.

While a powerful tool, the Fed rarely changes reserve requirements due to its potentially disruptive impact on bank operations.

2. The Discount Rate: The Lender of Last Resort

The discount rate is the interest rate at which commercial banks can borrow money directly from the Federal Reserve. Think of it as a backup source of funding for banks facing short-term liquidity needs.

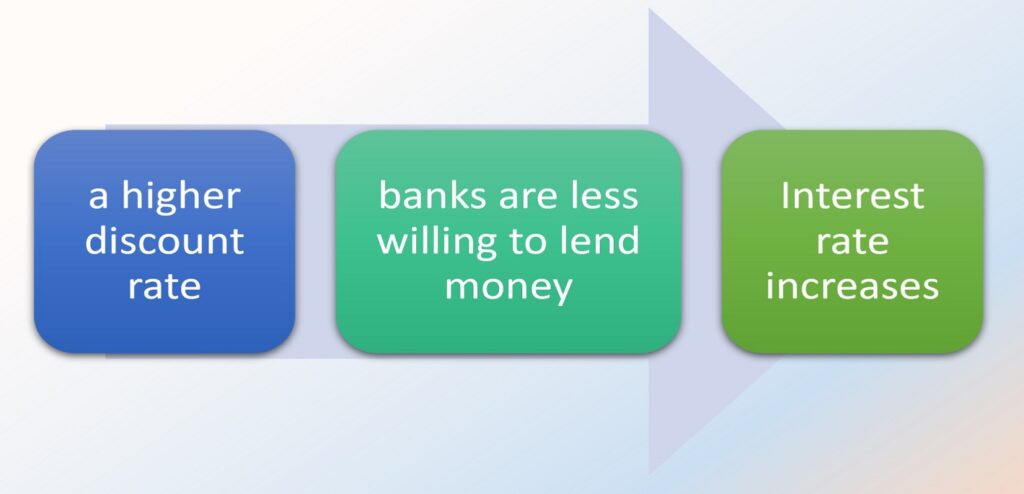

- Raising the discount rate: This makes it more expensive for banks to borrow from the Fed, which can translate to higher interest rates for consumers and businesses. This can help to cool down an overheating economy.

- Lowering the discount rate: This encourages banks to borrow from the Fed, potentially leading to lower interest rates for borrowers and stimulating economic activity.

The discount rate acts as a signal of the Fed’s intentions and influences short-term interest rates.

3. Open Market Operations: The Most Frequently Used Tool

Open market operations involve the Fed buying or selling U.S. government securities (like Treasury bonds) in the open market. This is the Fed’s most flexible and frequently used tool.

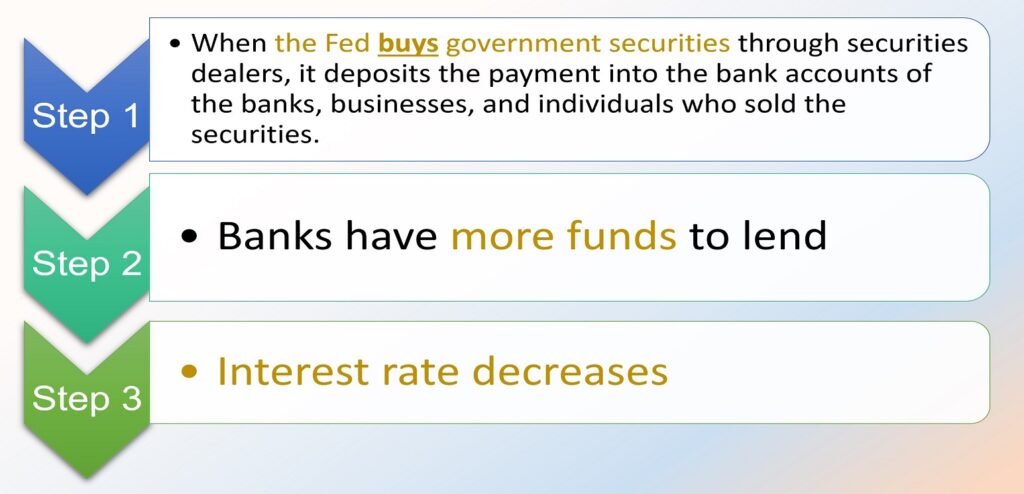

- Buying securities: When the Fed buys securities, it injects money into the banking system. This increases the money supply, puts downward pressure on interest rates, and encourages lending and investment.

- Selling securities: When the Fed sells securities, it withdraws money from the banking system. This decreases the money supply, puts upward pressure on interest rates, and can help to curb inflation.

Open market operations are conducted by the Federal Open Market Committee, which meets regularly to assess economic conditions and set monetary policy.

4. Interest on Reserve Balances: A Relatively New Tool

Since the 2008 financial crisis, the Fed has used interest on reserve balances (IORB) as a key tool. This is the interest rate the Fed pays to commercial banks on the reserves they hold at the Fed.

- Raising the IORB rate: This encourages banks to hold more reserves at the Fed, reducing the amount of money they lend out. This can help to tighten credit conditions and control inflation.

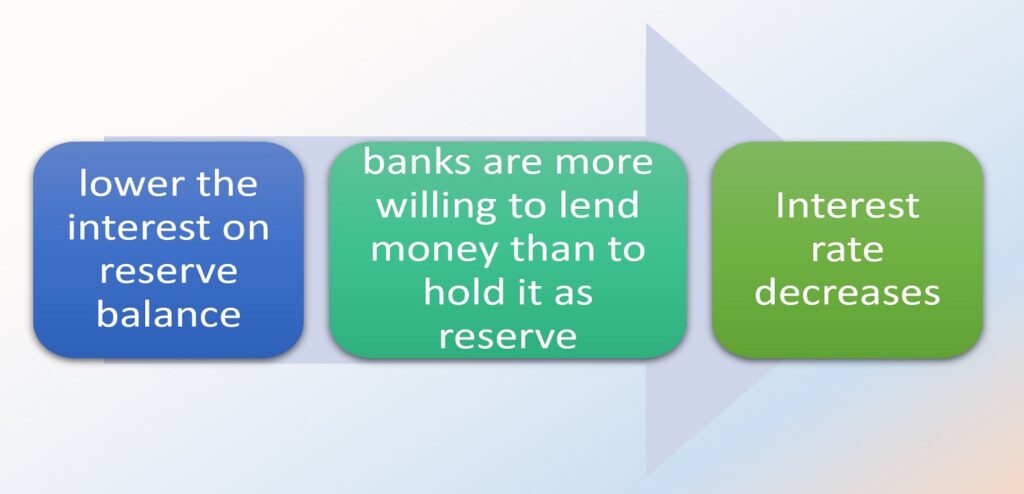

- Lowering the IORB rate: This encourages banks to lend out more money, as they earn less interest on reserves held at the Fed. This can help to ease credit conditions and stimulate economic growth.

IORB provides the Fed with greater control over short-term interest rates and the money supply.

The Fed’s Balancing Act

The Fed’s job is a delicate balancing act. It must carefully weigh the risks of inflation and unemployment when making policy decisions. By understanding the four tools in its toolkit, we can gain a better understanding of how the Fed influences our economy and our everyday lives.

For a more in-depth understanding of this topic, consider enrolling in FIN 4324 – Management of Financial Services or Finance courses at West Texas A&M University.