Information might be what moves the stock market, but the uncertainty surrounding information causes volatility. The 2020 presidential election is a perfect example of uncertain information, and the stock market’s reaction to it.

The event of President Donald Trump or former Vice President Joe Biden winning the presidential election is not the entire story. Instead, it is the interplay between the next president and the Senate and House of Representatives that investors must analyze.

As of November 7, 2020, Biden has not officially won but several news outlets have called the election for him. While there will be run-offs in the Georgia Senate races, it seems as though the Senate may stay with the Republicans. Democrats will hold the House even though they lost seats.

Political Race Gridlock Impact on Stock Market

Thus, there was no blue or red wave. Generally, stock markets like gridlock. Why? Any changes are generally slow which provides firms and investors time to adjust.

The federal government affects the stock market in three main ways. First, the obvious. Government spending moves the market because increases in government spending increase the recipient firms’ revenues and profits, which increases the stock price. The question investors must answer is which firms will receive increased government expenditures and which firms will lose a major buyer?

Biden Economy and Stock Market Implications

Biden’s platform includes transitioning the economy to more green energy. Whether the support comes in the form of direct government spending, taxation changes, or changes in regulation, green energy should benefit. While there are several stocks that demonstrate this concept, notice how the price for iShares Global Clean Energy ETF (ticker = ICLN) was volatile and lower on Wednesday morning when there was no winner, but jumped in price on Thursday when the counting of the mail-in ballots was clearly going in Biden’s favor.

Source: BigCharts from Marketwatch

Which sector might be a loser under a Biden Presidency? Defense may not get as much love. Wednesday morning Lockheed Martin’s stock price jumped, but then the price fell as those mail-in ballots are counted.

Source: BigCharts from Marketwatch

Regulation is the second way the federal government affects the stock market. Regulation is a cost to firms. Increase regulation and profits fall, driving down the stock price.

Trump Economy Stock Market Predictions

In terms of reduced regulation, President Trump’s focus on technology and antitrust may not be continued by the Biden Presidency. Investors seem to agree. Buying Google a day ahead of what we saw with clean energy, investors increased the price by over 5% on Wednesday.

Why would investors move sooner on Google? There is no one reason, but a reason is the split Congress with neither side having a clear mandate needed to push through contentious antitrust regulation.

Source: BigCharts from Marketwatch

Federal Government Stock Market Impacts

Taxation is the third main way the federal government affects the stock market. Biden has indicated that he wants to repeal some aspects of the 2017 tax cuts. Changes in the tax code work through the entire economic system in several ways. It would take us a long time to discuss each transmission channel of the tax code and the winners and losers of each one. However, for our purpose, REITs are a good example. Real Estate Investment Trusts (REITs) distribute 90% of their earnings as dividends in exchange of avoiding normal corporate income tax rates. An increase in corporate taxes will hurt REITs less than other sectors of the economy.

Additionally, a lower short-term interest rate from the Federal Reserve also helps REITs because they borrow significant amounts short-term. Neither side presented plans to increase short-term interest rates. Vanguard’s Real Estate ETF displays an increase in price. Notice that its price moved up on Tuesday, the day of the election. The split Congress decreases the chance for any major tax changes. While taxes may rise under Biden, REIT investors may have been thinking that there would not be as much of a change as there could have been with a blue wave.

Do you see the spike in volume at the end of Thursday? Investors are getting in before price rises any more. This spike in volume causes some investors to profit-take on Friday.

Source: BigCharts from Marketwatch

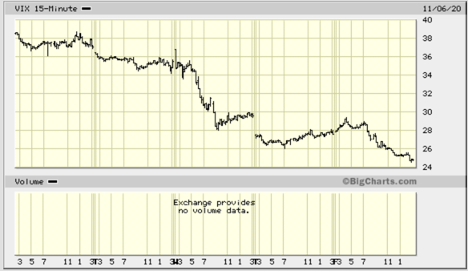

The best example of the stock market and the election is the VIX, the measure of volatility. It represents the market’s expectation of volatility looking ahead one month. When the VIX increases, it means there is more risk in the stock market or the economy.

Its movement during the week of the election did not match the other charts. It declined the entire week. Why? Because the election has ended and with winners declared, the ability for firms and investors to predict events more accurately increases. In other words, there is less risk in the market once we know who the winners are.

Source: BigCharts from Marketwatch

To see the value of the VIX, look at its chart over the month prior to the election. That last week of campaigning with all those polls that told different stories all meant risk. The VIX increased in response to that volatility. The VIX dropped on Wednesday once most of the races had been called. By Friday, when the mail-in ballots counts were nearing the end, volatility dropped again. The VIX returned to the level it was at the start of October.

Source: BigCharts from Marketwatch

Going forward, the stock market will continue to move on daily events and year-long trends. It is not a perfect predictor, but it does show what one segment of our economy is thinking and willingness to invest money.

Dr. Anne Macy

Gene Edwards Professor of Finance