I think everyone remembers the “great toilet paper shortage” of 2020, when toilet paper all of a sudden turned into one of the most coveted items in grocery stores during the early days of the pandemic. Fast-forward two years, the US is experiencing another shortage. This time however, the good that’s making headlines is baby formula. At the end of May, the national out-of-stock rate reached 74%, with some states even reporting out-of-stock rates upwards of 90%.

How did we get here?

In mid-February, Abbott announced a recall of Similac, Alimentum and EleCare formula manufactured at their Sturgis, Michigan plant due to potential contamination. Abbott is one of the main formula producers for the US market. They produce a significant proportion of their output at said plant. As a result, this incident triggered a nationwide shortage. To make matters worse, supply chain issues are making it difficult for the remaining plants to increase production.

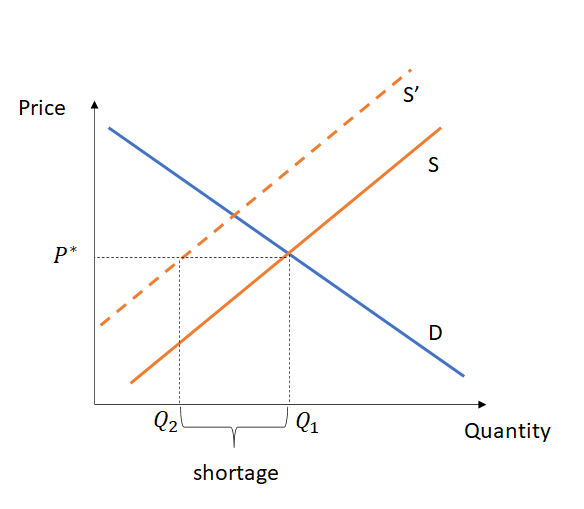

If you have ever taken a course in economics, what you most likely remember is the supply and demand model. Let’s see how we can use a supply and demand graph to illustrate what’s going on in the baby formula market. Prior to the recall, the market was at an “equilibrium”, where quantity supplied (at least roughly) matched quantity demanded (Q1 ). Removing the formula affected by the recall from the shelves and shutting down one of their plants represents a decrease in the supply of formula. Hence, the supply curve shifts to the left (see Figure 1).

Consumer demand has not changed and at current prices. They still want to buy Q1 units of formula. Quantity supplied however has decreased to Q2. Thus, we see a shortage in this market.

So, should you stock up?

For new parents, empty shelves in the formula section can be, at the very least, a little unnerving. Just like with toilet paper two years ago, people started to stock up. Crisis over, right?

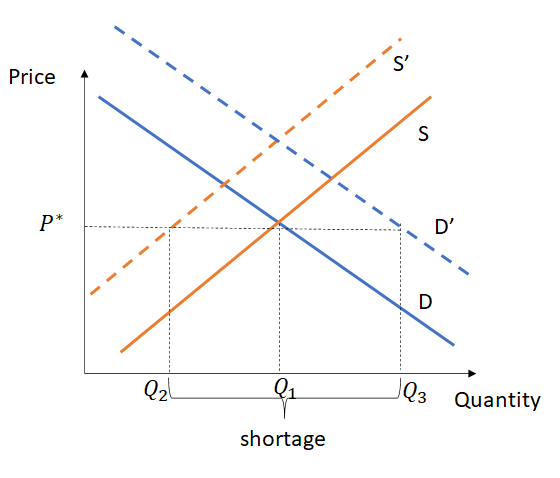

Well, not so fast. When people buy more formula than they currently need, they are shifting consumption from the future to the present. This increases the current demand for the product. As reported here, demand for baby formula increased by 13% since the recall. You may have seen videos like this one that went viral which shows a woman buying a cart full of formula. On our graph, we can represent that with a rightward shift of the demand curve to D’ (see Figure 2).

At the current market price P*, consumers now demand Q3, while firms only supply Q2. Compared to Figure 1, we see that the shortage has gotten even worse.

A concentrated industry

Obviously, this situation isn’t good – babies need to eat after all. Another complicating factor is that the formula market is highly concentrated. Four producers (Abbott, Mead Johnson, Perrigo, Gerber/Nestle) account for over 90% of baby formula produced in the US. There are a few reasons for this high market concentration.

First, baby formula is a product where we’d expect average production costs to decrease as production increases. In other words, large producers can provide the formula at a cheaper price than a small competitor could. Another reason is that the largest customer for these firms, accounting for roughly half of the market, is the US Department of Agriculture through the WIC program. The formula producers bid on these state contracts to be the state’s supplier of infant formula. In 2022, Abbott is the WIC supplier for 35 states that account for 47% of the infants participating in WIC. Mead Johnson (41%) and Gerber (12%) supply the remaining states.

What now?

Ok, so we don’t have much domestic competition. But there have to be formula producers in other countries around the world? There sure are, but prior to the shortage, the US had strict import restrictions and tariffs up to 17.5% on imported formula. This made it difficult for foreign producers to sell their product in the US and protects domestic producers from international competition.

In response to the current shortage, the US has eased import restrictions to increase the supply of formula. More recently, the FDA also announced that they were working on plans to allow foreign producers to sell formula in the US beyond the current crisis to diversify the domestic supply.

Moreover, the Abbott plant in Michigan has been reopened for production as well. All of this is good news for parents who have been struggling to find formula for their babies. Supply is bound to increase, hopefully ending the shortage in the not-so-distant future. Fingers crossed, that new parents soon will spend more time snuggling their babies and less time searching for formula!

To learn more about how economic markets work, become a Buff and take courses such as microeconomics or industrial organization.

Anne-Christine Barthel

Assistant Professor of Economics and Decision Management