At the time of this writing, 45 million Americans owe more than $1.71 trillion in student loan debt. To put this in perspective, there is more student loan debt than all car loans in America, and more student loan debt than all credit card debt in America.

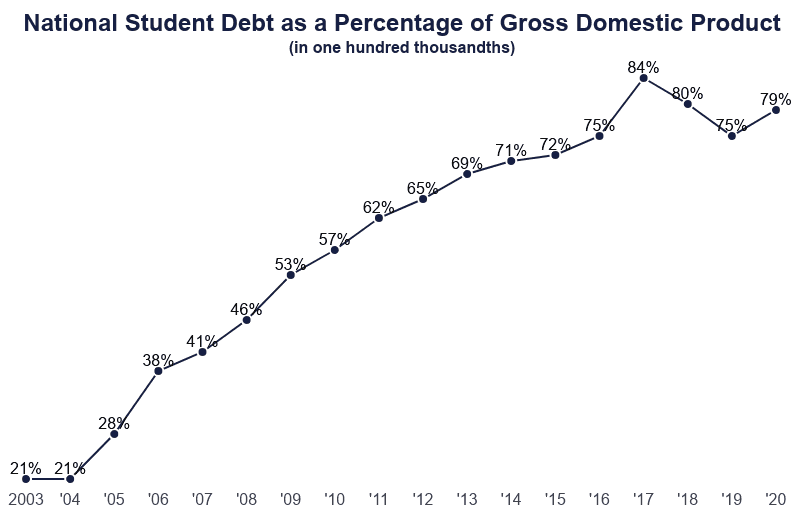

The national student loan balance has increased since the early 2000s. Shortly after the financial crisis of 2007-08, the enrollment at private and public universities increased, and so did the amount of debt related to this increase.

In the past 10 years, college costs have steadily increased. Roughly 70 percent of college students take out loans to pay for their education. According to Educationdata.org, the average federal student loan debt is slightly under $37,000. Typically, a Texas college student graduates with a loan debt around $30,000. As you can imagine, these averages increase if we focus on medical school graduates, dental school graduates, pharmacy school graduates, veterinary school graduates, or graduate students.

Benefits of Student Loans

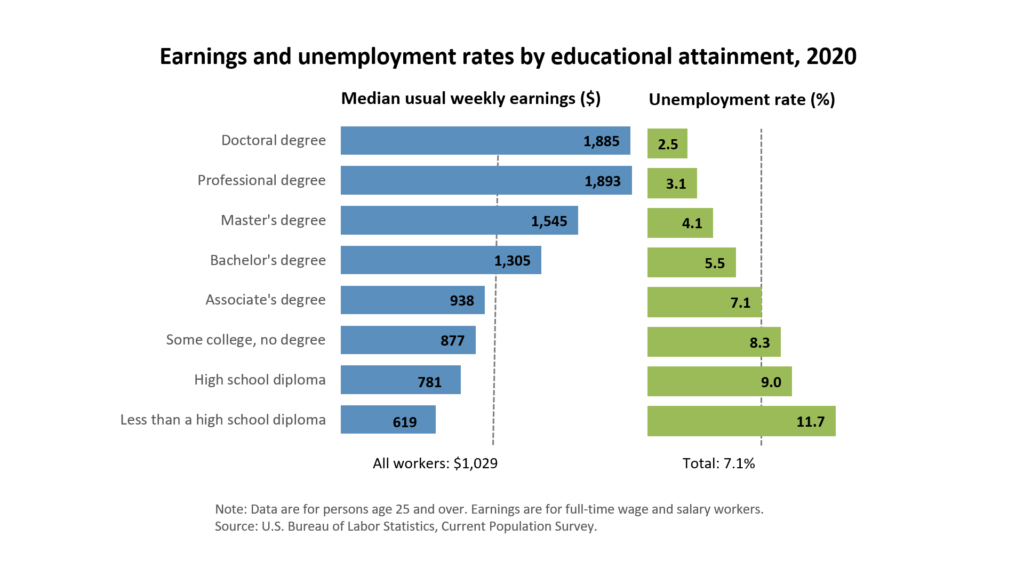

According to the US. Bureau of Labor Statistics, a college education is a solid investment in one’s financial future and increases job security. When students decide to acquire an education, it’s often to provide a better life for themselves and their loved ones, gain a competitive advantage in the job market, and potentially increase their earning potential.

Some students are fortunate enough to have educational savings, scholarships and grants, and parents or family members to assist with paying for their education. While others might use a combination of these sources, many other students work during school and acquire student loans. Students obtaining borrowing money may or may not fully grasp the consequences of mismanaged debt or how debt accumulation could negatively affect their financial futures.

Effects of Student Loan Debt

Student loan debt affects borrowers in different ways. Borrowers that are fiscally constrained limit their relocation opportunities after college, and many across the country have been known to delay home-buying. Some students even postpone pursuing a graduate school degree to work more and pay off current debt before they consider accumulating more educational debt.

Unfortunately, some borrowers are so financially strapped that they delay saving for retirement. We can all ask a loved one or a friend approaching retirement or living out their retirement days this question: “How important is saving for retirement?” Every time I’ve asked someone that question, the response I receive is, “Very important, and start early!”

Prior to the pandemic, one in four borrowers was behind on their student loan payments, and one in five was in default and had not been able to make a payment in nine months.

At the time of this writing, $165 million in student loan debt is in default, and this number might increase once the federal mandated pause on student loan debt payment expires in September 2021.

Is There Any Relief In Sight?

More than ever, government officials are serious about addressing student loan debt concerns. The Biden administration is discussing options and assisting borrowers with student loan debt relief. The options being discussed are:

- The potential forgiveness of $10,000 for all student loan borrowers.

- The cancellation of up to $50,000 worth of debt per borrower.

- The continued modification of repayment plans.

Proponents of student loan forgiveness or cancellation argue that these measures will allow borrowers to free up income and help boost the U.S. economy. In contrast, others claim the cancelation of student loans is not fair and would only cause future financial turmoil. One thing is for sure: Americans have accumulated a significant amount of student loan debt, and borrowers are paying close attention to what is going to happen next!

To be continued…

Dr. Oscar Solis

Associate Professor of Finance & Gene Edwards Professor of Financial Planning