Ever wondered why central banks obsess over a seemingly simple number – the interest rate? This seemingly minor adjustment can have far-reaching consequences, affecting the economy from housing prices to stock markets. Let’s delve into the world of interest rates and uncover their hidden power.

What Are Interest Rates?

At its core, an interest rate represents the cost of borrowing money or the reward for saving money. For instance:

- If the interest rate is 5%, depositing $100 in the bank today means you’ll have $105 next year.

- Conversely, borrowing $100 means you’ll repay $105 in a year.

Essentially, interest rates reflect the time value of money—how much today’s money is worth compared to the future.

Why Are Interest Rates So Important?

1. Encouraging or Discouraging Spending

- Saving becomes less attractive because banks offer negligible returns.

- Borrowing becomes cheaper, encouraging individuals and businesses to take loans.

Imagine a scenario where the rate drop from 5% to 1%:

People are likely to:

- Spend on homes, cars, or luxury goods.

- Invest in businesses, fueling job creation and innovation.

This stimulates economic activity as money circulates more rapidly. On the flip side, when the rates rise, borrowing becomes expensive, discouraging spending and cooling down an overheated economy.

2. Managing Inflation

Central banks adjust interest rates to control inflation:

- Lowering rates boosts economic activity but can lead to higher demand, driving up prices (inflation).

- Raising rates suppresses inflation by reducing demand, as loans and mortgages become costlier.

For example:

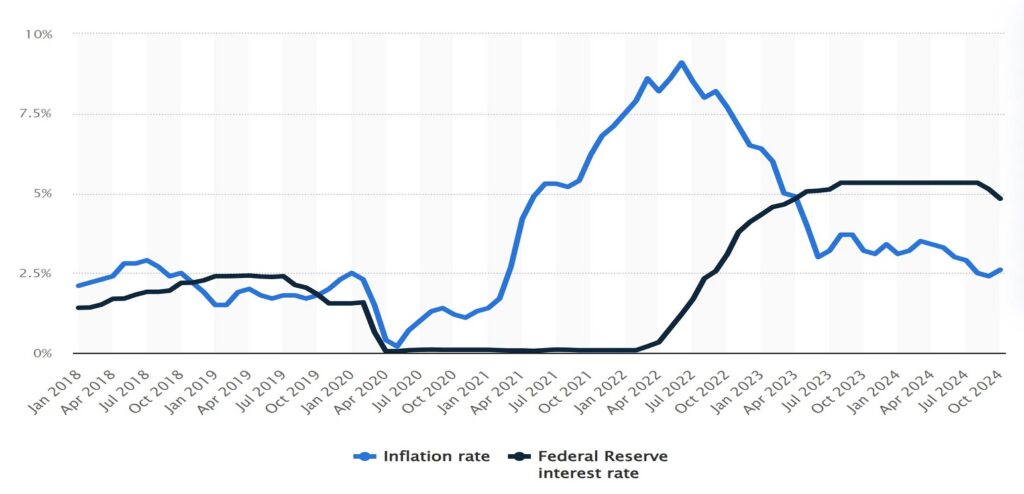

- In 2022, central banks worldwide raised rates to combat high inflation. The U.S. Federal Reserve increased rates by 0.5% in May, while the European Central Bank announced plans to follow suit.

How Interest Rates Affect the Economy

1. Impact on Businesses

When interest rates rise:

- Businesses face higher borrowing costs, limiting expansion plans.

- Consumer spending declines, reducing company revenues.

Conversely, when rates fall:

- Companies borrow more to expand, hire staff, and invest in innovation.

- Increased consumer spending boosts profits.

For example, during the COVID-19 pandemic, central banks like the Federal Reserve slashed interest rates to near zero to support struggling businesses.

2. Effect on Inflation and Employment

There’s a trade-off between stimulating the economy and managing inflation:

- Low rates: Encourage job creation and economic growth but risk higher inflation.

- High rates: Help control inflation but can lead to job losses as businesses cut costs.

3. Stock Market Dynamics

Interest rate changes ripple through the stock market in several ways:

- Cost of capital: Higher rates increase the cost of borrowing for businesses, hurting growth and profitability, especially for sectors like tech and real estate.

- Consumer demand: Higher borrowing costs dampen spending, affecting companies reliant on consumer purchases.

- Investment attractiveness: When bond yields rise due to higher interest rates, stocks may seem less appealing, prompting a shift in investment strategies.

For example:

- Growth stocks (like tech startups) often suffer during rate hikes because their valuations rely heavily on future earnings, which are discounted more heavily at higher rates.

Examples: Real-Life Impacts

1. Housing Market

- Lower interest rates mean cheaper mortgages, boosting demand for homes. Sellers benefit from higher prices, creating a wealth effect that fuels further spending.

- Higher rates cool housing markets as loans become unaffordable, leading to reduced demand and potentially lower prices.

2. Currency Exchange Rates

Interest rates directly influence currency values:

- Higher rates attract foreign investment, strengthening the currency.

- Lower rates make a currency less attractive, potentially leading to depreciation.

For example:

- The U.S. dollar often strengthens during rate hikes by the Federal Reserve, as higher returns attract global investors.

3. Consumer Behavior

When borrowing costs rise, purchases requiring loans (like cars and appliances) decline. Conversely, lower rates encourage consumers to spend rather than save, boosting retail sales and economic growth.

The Big Picture

Interest rates are a vital tool in managing the economy. They influence:

- How much people save, spend, and invest.

- Business decisions regarding expansion and hiring.

- Government policies to manage inflation and unemployment.

By understanding the interplay between interest rates and broader economic dynamics, you can gain valuable insights into financial decision-making, whether in personal finance, entrepreneurship, or investment.

As you follow news about central bank decisions or economic trends, remember: behind every rate hike or cut lies a carefully calculated attempt to balance growth with stability. Whether you’re planning your budget or investing in the stock market, interest rates remain a key variable shaping your financial landscape.

If you’re interested in learning more, consider enrolling in FIN 3320 – Business Finance or advanced finance coursework at West Texas A&M University.