In response to the current economic situation, the Federal Reserve has lowered interest rates to near zero percent and intends to keep them between zero and ¼ percent. In economics, interest rates, especially the federal funds rate, being at zero percent is called the zero lower bound. Holding interest rates near zero is a risky proposition for the Federal Reserve, as it denies banks their safest and most reliable revenue, forcing them to take on riskier loans. The 2008 financial crisis was caused by low interest rates which encouraged banks to take on riskier loans to find better returns on their lending. Banks had too many liabilities and too little capital.

There are several other dangers in the short run as well. The biggest danger, however, may be the long-term consequences for the economy, if the Federal Reserve intends to hold this strategy. Holding interest rates near zero for too long creates structural problems in the economy over the long-term in every part of the economy. No industry is likely to escape the damages done by a too-low for too-long strategy. The four long-term problems with persistently low-interest rates are debt traps, poor credit allocation, poor allocation of resources, and damage to the financial system.

Low Interest Rate Debt Trap

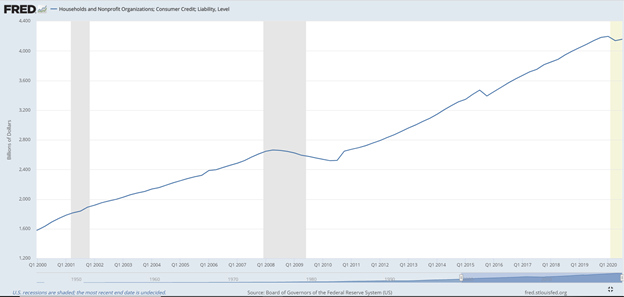

With chronically low-interest rates, households and governments have accumulated enormous debt burdens, forming the potential for a debt trap. The combination of this high level of indebtedness with low-interest rates holds aggregate demand hostage, as rising interest rates threaten both households’ and governments’ ability to repay their debts. The artificially low-interest rates, created by the Federal Reserve, give households and governments the wrong price for borrowing. Both are fooled into thinking taking on debt is cheaper than it really will be, causing them to borrow more than they otherwise would. When the Federal Reserve eventually returns to increasing rates, they risk the solvency of these households and governments whom are already overburdened.

Poor Credit Allocation

When banks are lured into lending to riskier borrowers, they do so in part by lending to ailing businesses. These businesses are trying to stay afloat by borrowing, and would not otherwise be able to without the artificially low-interest rates. By keeping these businesses afloat, many poorly-performing businesses survive and take up valuable capital, labor, and other resources, denying them to more productive firms. This phenomenon has come to be known as “zombie firms”. The starkest example is the Lost Decade in Japan. Japan’s economic struggles in the 1990s were caused by these zombie firms.

Poor Allocation of Resources

This bad credit allocation then impacts the ability of an economy to efficiently allocate resources. An economy grows by having market forces get valuable and scarce resources into the businesses that are most productive. With a distorted price system, bad credit allocation, and zombie firms, these limited resources are squandered. Employment, income, investment, and competition are hurt when inefficient businesses are not driven out of the market by better ones. Businesses that are more worthy of receiving credit, do not receive it, or have the value of the credit they do receive diluted by the lending happening to riskier and ailing businesses. The result is slowed economic growth and delayed recovery.

Systemic Risk

Banks are hurt by lower interest rates as their traditional sources of income dry up, and they are forced to pick out riskier and riskier households and businesses to whom to lend. They survive the short-term danger by making more dangerous loans, but eventually, this is unsustainable, and the cost of making these risky loans catches up to the banks. The more dire cost, however, is that when many banks employ this strategy, it jeopardizes the whole financial system. The financial system is interconnected in ways that other industries are not. When one bank goes bankrupt, it endangers the other banks with whom it does business. Economists call this systemic risk, and it was one of the main perils of the 2008 financial crisis.

The Real Danger of Low Interest Rates

In summary, the Federal Reserve’s current strategy of holding interest rates near zero for an extended time poses four major hazards to the economy: debt traps, poor credit allocation, poor resource allocation and systemic risk. The combined effect of these reduces employment, investment, income, and economic growth, as well as making the economy more at risk for major financial collapse.

To hear more discussion on low interest rates and the damage they might be causing, including what policies might be put in place to attempt to mitigate the effects of these interest rates and what the limitations of those policies are, be sure to check out EconBuff Podcast #17 where I interview economist and West Texas A&M University College of Business faculty member, Dr. Ryan Mattson, about low-interest rates.

Dr. Mattson lays out the short run effects of low and negative interest rates and how that impacts private banks and the shadow banking system. We explore the long term problems stemming from persistently low rates, what mechanisms negative interest rates might effects banks through and how Dr. Mattson views our options for getting away from negative interest rates.