We can feel our day-to-day living expenses have been rising in the past year due to inflation. Groceries keep getting more expensive. Gas prices in Texas are highest in seven years. How much are prices up?

U.S. inflation is spiking to its highest level in decades

The Bureau of Labor Statistics said the consumer-price index (CPI)— which measures the average change over time in the prices paid by urban consumers for goods and services—surged 6.9% from November 2020 to November 2021, the largest 12-month increase since the period ending June 1982.

Jack Dorsey, co-founder of Twitter, wrote: “Hyperinflation is going to change everything,” adding that “it’s happening.”

Fed officials have attributed the inflation jump to the pandemic factors. Strong consumer demand for goods and supply chain disruptions have been major factors. What about the inflation rate in the near future? Considering that November CPI came before the emergence of the Omicron variant, which poses a new threat to the economy, it is challenging for the regulators to deal with price increases and keep the inflation at a level close to the Fed’s target inflation rate of 2%. Facing surging inflation, how can you protect your money against inflation?

Think twice before investing in individual stocks

Some people may consider stocks, which enjoyed returns of about 24% in 2021 (e.g., S&P 500 index funds), while many people doubt that it is a good time to buy stocks as the stock market keeps hitting new record highs. The recent Rivian frenzy makes me think twice about buying individual stocks.

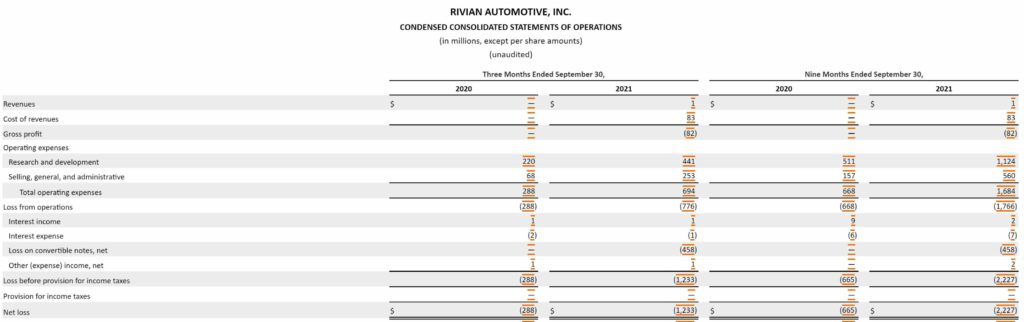

Rivian Automotive, an electric vehicle automaker, surpassed General Motors to become the nation’s second most valuable automaker (based on the market capitalization as of November 2021), but if you check Rivian’s production capacity and financial statements, you may not believe its valuation. The company has delivered about 150 electric pickup trucks mostly to employees with a market capitalization of $83 billion as of December 17, 2021, whereas Tesla, the largest carmaker by market value, has sold around 627,300 vehicles this year and amassed a market value of $936 billion. Its 9-month revenues as of September 30, 2021 were just $1 million. Thus, it will take years before today’s valuation can be justified and there is significant amount of risk involved. If you are quite risk averse and don’t want to take excessive risk, it may be not a good time to pick your own stocks.

Get the inflation protection with the Treasury I bonds that currently pay a risk free 7.12%

If you just want to protect your money from inflation and don’t want to take high risk in stock investment, buying Series I savings bonds are a good choice.

Series I Saving Bonds

I bonds are issued by the US Treasury. This is one of the safest ways to invest your money.

Interest rate

I Bond interest rate is a combination of two separate rates—a fixed rate of return and a variable semiannual inflation rate. Thus, a higher inflation rate, a higher I bond interest rate. That way, you are protected by inflation.

The current composite rate on Series I savings bonds issued between November 2011 and April 2022 is 7.12%, which is a phenomenal rate considering that the interest rates on most savings accounts and certificates of deposit are under 1%. The rate adjusts on these bonds every six month, based on changes in the non-seasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U) for all items, including food and energy. The rate locks for 6 months from your purchase date and then updates to the new rate for the following 6 months. If inflation rises, the rate will go up when it resets.

Tax Considerations

- I Bond interest accrues in your account over the time you hold it. You only pay tax when you redeem your bond.

- Savings bonds are exempt from taxation by any State or political subdivision of a State.

- Interest earnings are subject to Federal income tax.

- Interest earnings may be excluded from Federal income tax when used to finance education.

Limitations

- A U.S. resident with a social security number can buy up to $10,000 worth of I Bonds each calendar year. You can also use your tax refund to buy additional I Bonds, up to $5,000. You can also buy the bonds for your children. If you have a family with children, you can easily scale up your investment.

- You have to lock the money in for a year; after that you can pull the funds out with a 3-month penalty. If you leave the money in for 5 years, there is no penalty.

The Treasury I Bonds offer great inflation protection and are a very safe way to invest your excess cash. If you want to beat inflation and don’t want to make risky investment, consider purchasing the Treasury I bonds.

See treasurydirect.gov for more information.

Wei Zhang

Assistant Professor of Finance