The credit card industry has not been immune to the COVID-19 pandemic. Credit card issuers and financial institutions have faced challenges in 2020 and 2021. These challenges are expected to continue into 2022 and beyond.

On a positive note, the vaccines, government relief payments, and other safety precautions have allowed some companies to begin returning to financial prosperity. Nonetheless, the pandemic has influenced credit card issuers and financial institutions. They are more selective when extending credit to borrowers, and they are revitalizing existing credit card promotions and products.

Credit Card Issuers Providing More Assistance

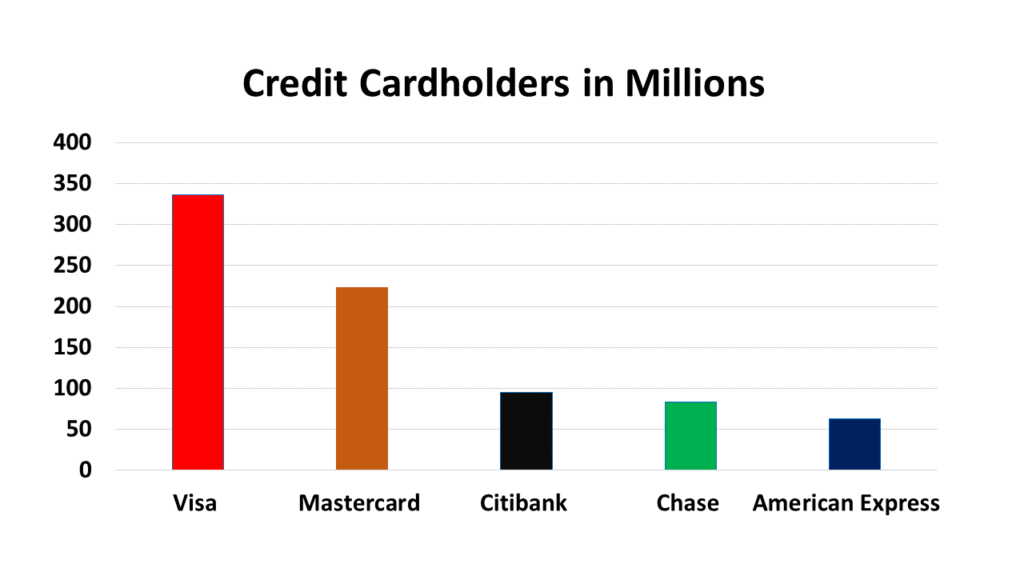

The five major credit card issuers are Visa, MasterCard, Citibank, Chase, and American Express. According to CardRates.com, Visa, the world leader in digital payments, has the most credit card cardholders among the top five issuers with 336 million cardholders.

The pandemic has highlighted the need to communicate credit card terms and conditions. Most credit card issuers have notified cardholders that general guidance, customer care, and COVID-19 relief are available. Some available relief options include changing the due date to accommodate budgets and more flexibility in refunding late fees.

Lowered Debt, Tighter Reins

According to the State of Credit 2021 from Experian, a consumer credit reporting company, the average credit card debt for American households is $5,525. For consumers, though, the pandemic has positively impacted levels of credit card debt. For example, consumers spent less on dining due to COIVD-19 safety protocols and restrictions. This lowered the average credit card debt and lowered delinquency compared to 2019 and 2020.

In 2021, consumers who need new credit might find themselves in a predicament. As a result of the pandemic, since March 2020 banks and other financial institutions have been hesitant on issuing new credit to consumers. They’ve now tightened the reins on the criteria for consumer approval. Subsequently, banks are screening customers with a fine-tooth comb, trying to ensure that customers will be able to make their payments on time.

Despite the shift in approval strategies, there are indications that credit approvals and other industries will bounce back. The downside for consumers is that once financial institutions begin to loosen credit approval requirements and the approvals begin to increase, the interest rates will also begin to increase.

Revitalizing New and Existing Products

Credit card issuers and financial institutions have simplified their products, tweaked existing products, and added new products. For example, Wells Fargo has streamlined their credit card products and now only offers three personal credit card options. In October 2021, the company introduced a new credit card that rewards cardholders for making payments on time.

According to CreditCard.com, credit card issuers are offering lower interest rates than in years past, as well as longer introductory rates.

When consumers open a credit card today, they are receiving a lower interest for more months, compared to the terms prior to the pandemic. For example, a card might have an introductory rate of zero percent interest for three months before increasing to a higher interest rate. Now the introductory rates are more along the lines of six months to nine months. Borrowing at a lower interest rate might encourage consumers to make more purchases.

Consumers with existing credit cards are taking advantage of promotional rates offered by banks and financial institutions. For example, if a consumer has an existing interest rate of 14.99 percent, the company might offer a rate below 10 percent for the next 12 months on all new purchases and balance transfers.

For some consumers, the opportunity to minimize interest payments may nudge them to use their credit cards more. Ultimately, credit card issuers and financial institutions are making adjustments to existing products to increase consumer spending. In doing so, the issuers and institutions are fueling the economy.

Utilizing Rewards

To ramp up credit card usage, numerous banks and credit card issuers are offering reward incentives for users. The two main types of rewards cards offer cashback and travel incentives. More and more financial companies partner with retail companies to increase business.

When compared to travel programs, cashback rewards are garnering more attention from credit card issuers and consumers. A cashback card earns rewards for certain purchases that can be redeemed in multiple ways. Consumers can direct the rewards towards credit card payment, purchase gift cards, buy airline tickets, and more.

The travel rewards programs have taken a hit since the pandemic started. The rewards are earned through airfare, hotel stays, car rentals, and cruises, all of which have been negatively impacted by COVID-19. Once we reach a post-COVID world and life gets back to “normal,” the travel industry will pick up, making travel rewards programs more enticing.

The credit card industry is also experimenting with rewards cards. In an effort to entice consumers, Chase launched a revamped Southwest Airlines credit card in October 2021. The temporary promotion is for those wanting to accumulate travel rewards. The company is offering several tiered incentives based on credit card usage. For those consumers looking for a card with a signing bonus and generous rewards accumulation, this card is worth researching and pursuing.

Credit Card Industry: Adapting to Changing Times

As the pandemic and the economy continue to evolve, credit card issuers and financial institutions have adapted to the changing times. In my view, the pandemic has permanently altered the credit card industry. Financial institutions will continue to be cautious with credit card approvals and will create more opportunities to help consumers throughout the pandemic and beyond.

Dr. Oscar Solis

Associate Professor of Finance & Gene Edwards Professor of Financial Planning