If January is an optimal time to evaluate your financial health and plan your financial strategies for the year, this mid-year time period offers a great opportunity to check in on your progress. Three areas to review are your budget, credit report, and household debt.

Maintain Your Budget

The first financial health tip is to update and maintain your budget. You can also think of your budget as a spending plan.

How has your budget worked for you in the first half of the year? Is your budget in great shape? Are you operating without a budget? Regardless of the status of your budget, it’s not too late in the year to start budgeting.

If you are in a position where you have been successfully completing your budget during the first half of the year, kudos!

When you are able to project and track your actual expenses and income from the beginning to the end of each month, you’re truly placing yourself and your family in a solid financial position. You are able to assess if you are spending less than you make and are able to cover your expenses each month.

Do not beat yourself up if you have not completed your budget. Today is the time to start! Be sure to check out my previous blog post about budgeting apps and other helpful tips regarding budgeting.

Review Your Credit Report

The second financial health tip is to review at least one of your three credit reports: Experian, Equifax, or Transunion. If you are in a position where you already monitor and know what is on your credit report, kudos to you!

If you have not been able to pull and examine your credit report this year, this is a good time to review it.

I strongly encourage you to pull your credit – all three of the credit reports, if you’ve never done this. The main reason you want to pull all three reports is to ensure that your information is accurate on your reports.

Some businesses and financial institutions may report specifically to one or the other. In some cases, negative information might be on one credit report and not on the other. Initially, it is important to understand what is on each of your credit reports. In the future, you will want to stagger when you pull your credit reports. For example, one credit report in March, another in July, and the third in November. This will allow you to review all three credit reports throughout the year.

Another resource to monitor your credit report and access your credit score is CreditKarma. This is a good, free resource to monitor your credit activity. However, the website only gives access to TransUnion and Equifax.

Why Is This Important

Do not underestimate the power and wisdom of reviewing your credit reports periodically. One of the main reasons is due to the increase in identity theft and fraud.

As of June 2023, the Federal Trade Commission received 5.7 million total fraud and identity theft reports, 1.4 million of which were identity theft cases. This is an increase from 2022 for identity theft, where over 1.1 million individuals reported being a victim for the year.

Monitoring your credit report can help you discover whether you’ve been a victim of identity theft or catch any fraudulent activity early. Especially before substantial damage could be done to your financial reputation. It’s never too late to check your credit.

Minimize Your Household Debt

The third financial health tip is to assess your household debt, such as mortgage, automobile, credit card, and student loan debt.

If you are debt-free, well done!

According to the Federal Reserve, American household debt hit a record $16.9 trillion, an amount shared by 340 million Americans, at the end of 2022. Yes, the figure includes seven zeros!

According to Debt.org, Americans owe $11.92 trillion on mortgages and $1.55 trillion on automobile loans. The website highlights that Americans owe $986 billion on credit cards, surpassing the pre-pandemic high of $927 billion.

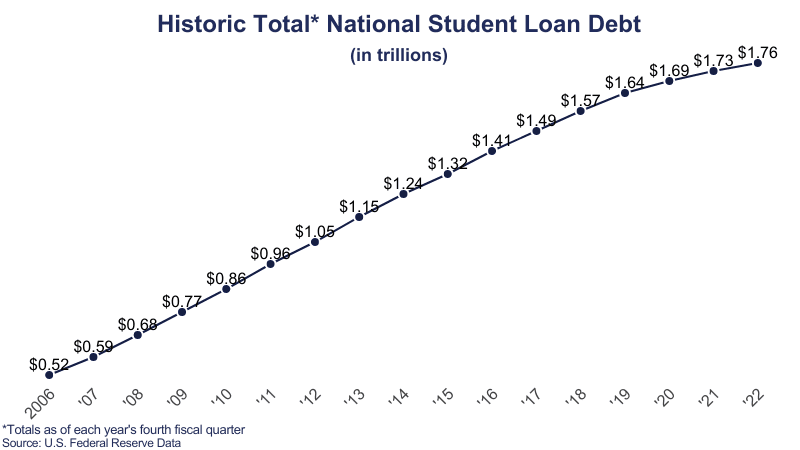

Furthermore, Educationdata.org reported $1.76 trillion in student loan debt.

The level of average consumer debt in America is on the rise. Now is the time to assess your debt and minimize the amount.

Some individuals and families in the United States might have to finance big-ticket items such as mortgages, automobiles, and education. However, all of these debts can be costly to you or your family’s financial future.

Paying more than the minimum payment is paramount. As the old adage says, “What is the best way to eat an elephant?” The answer: “One bite at a time.” (Figuratively speaking, of course!) In the case of household debt, however, we need to take big bites! Pay as much as you can each month – more than the minimum – so that you can reduce your debt and the costs of interest over time.

If you are maintaining your budget, monitoring your credit, and minimizing your debt, keep doing what you’re doing. For everyone else, this is a great time to start a budget, review your credit, and pay down debt.

You can do it! And if you need more motivation, remember this: Your future self will thank you!