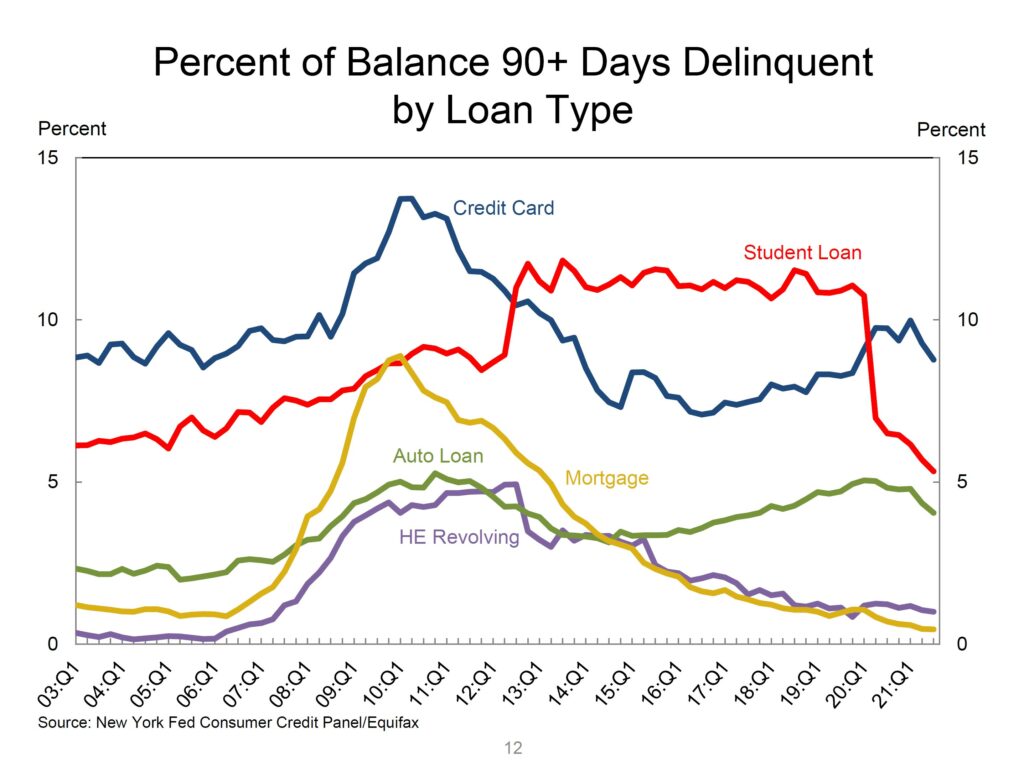

Most federal student loan payments have been on pause since March 2020 under the CARES Act. That explains the dramatic decrease in the delinquency rate of student loan in 2020 Q1. The latest news is that Biden plans to restart federal student loan payments in May 2022. That means more than 40 million federal student loan borrowers need to adjust their budgets. One option for them is to refinance their student loans through Fintech lenders.

A growing trend in the student loan refinancing market (before the federal student loan payment freeze) is that more and more people choose to refinance their loans through FinTech lenders, rather than traditional lenders. However, as I will explain later, refinancing student loans through FinTech lenders has pros and cons. It is worthwhile to look at why both lenders and regulators care about the student loan market.

Fast Growing Student Loan

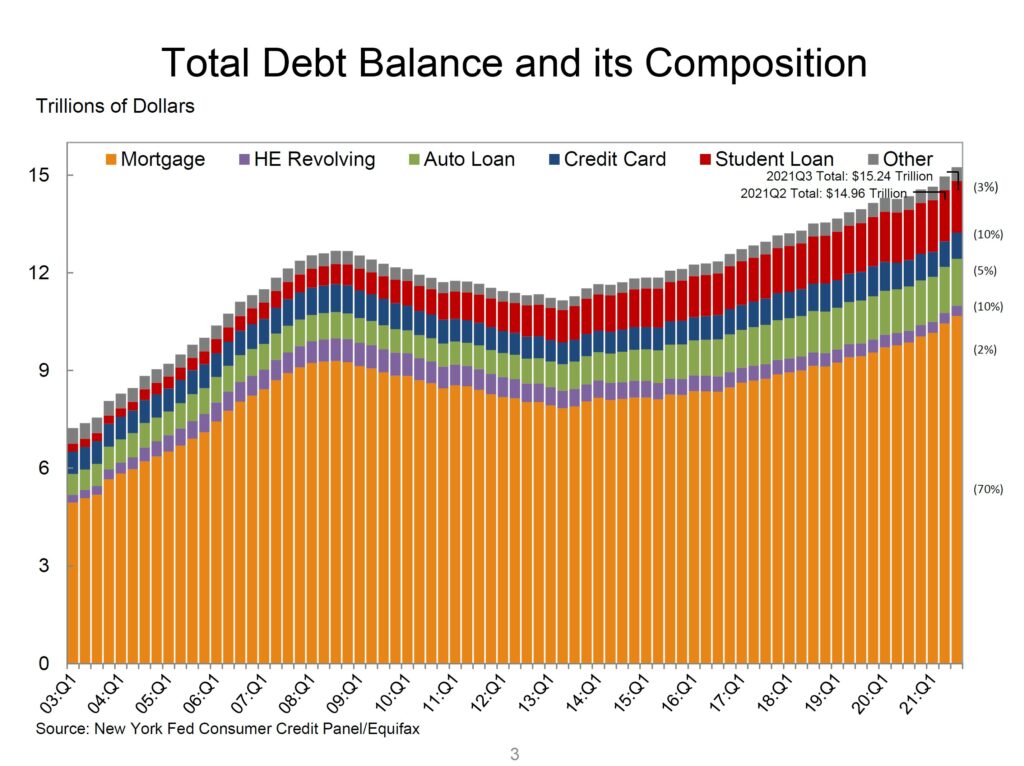

Student loan is now the second highest form of consumer debt after mortgages. As reported by the Federal Reserve, student loan balance has been growing fast after the 2008 financial crisis. Why is student loan balance growing so fast? According to Moody’s, one of the main reasons is the income-driven repayment plan.

Income-driven Repayment for Federal Student Loans

If you have trouble paying your monthly federal student loans, you can apply for the income-driven repayment plan. It will cap your monthly payments at a certain percentage of your discretionary income. If the income is low enough, your payment could be as low as $0 per month. The main purpose of the plan is to provide short-term financial relief.

Another benefit of the repayment plan is that if you make on-time payments each month for 20 or 25 years and meet the other requirements for loan forgiveness, you will qualify for forgiveness of any loan balance that remains at the end of the 20- or 25-year period.

But the plan is potentially more expensive in the long term. Why? Although the monthly payment is reduced, if the payment doesn’t cover the interests that accrued before, then the interests you didn’t pay will be added to the loan balance. Thus, your student loan balance could go up. Note that interest is compounded. We know the power of compounding. Before you consider refinancing your student loans, you should understand how the Federal student loan interest rates are determined.

Drawback of Federal Student Loan to Some Students: No Risk-Based Pricing

Interest rates on federal student loans are set by federal law and adjusted each school year. The rates equal the yield on 10-year Treasury note plus a fixed spread.

A feature of the federal student loan is that those who take out a federal student loan in the same time frame have the same interest rate. These rates apply to all students regardless of their credit history (i.e., no risk-based pricing). That means that it doesn’t try to sort out the good risks from the bad risks. Thus, everybody is pooled together and offered the same rate.

The virtue of taking out a federal student loan is the variety of deferments and income-driven programs available afterward. However, there is some downside you should not ignore. That is you’re paying a rate that reflects an average risk of the pool of borrowers, rather than your specific risk. If you’re among the graduates doing better, you can borrow at a lower spread that reflects your lower risk. This is where FinTech lenders can play a role.

Introduction to FinTech

FinTech is short for financial technology (see the article by Dr. Solis). The Review of Financial Studies, one of the top three finance journals, published an article titled To FinTech and Beyond (Goldstein et al., 2019)), saying “FinTech is about the introduction of new technologies into the financial sector, and it is now revolutionizing the financial industry.” Many believe that recent advances in artificial intelligence, Big Data, etc. will soon produce a quantum leap in how financial services are provided.

The FinTech companies are more aggressive in embracing risks associated with new products and technologies. For example, Square is a merchant services aggregator and mobile payment company. It offers short-term business loans to small businesses that use the company’s point-of-sale system for payment processing.

The major advantage of Square over other traditional lenders is that as a payment aggregator, it can see every sale, every tip, and every single transaction of a merchant. Such information can be the basis of a loan offer. Based on its information advantage, Square can make better judgements about the merchant’s future cash flows. As a comparison, traditional banks often have to evaluate the performance of small businesses based on their financial statements.

Therefore, if you run a small business and your cash flows can hardly be monitored or verified by traditional banks, you may consider borrowing from a payment aggregator. The latter can easily monitor your daily operations. Similarly, if you’re among the graduates doing better, then you may consider refinancing your student loans from FinTech lenders, who potentially agree with your promising prospect and give you a high credit rating.

Refinancing Federal Student Loan through FinTech Lenders

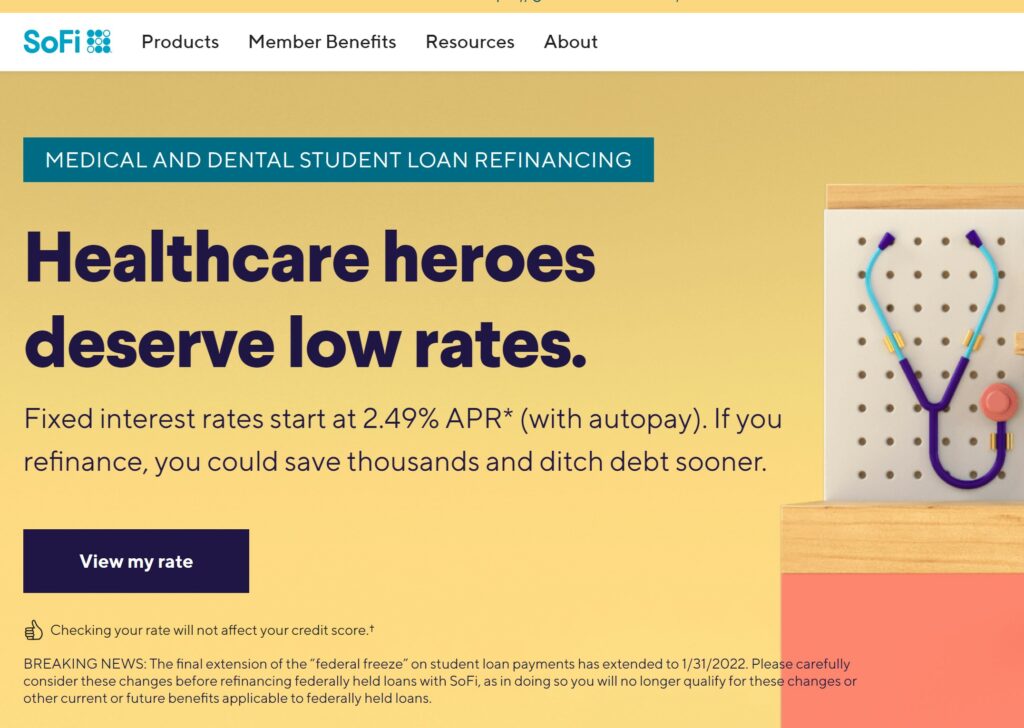

Because federal student loan offers no risk-based pricing, graduates who are doing better or have high growth potential may find it attractive to refinance their student loans through FinTech lenders to get lower interest rates. For example, the business model of SoFi is to refinance the lower-risk borrowers out of their student loans to a better rate. It is now one of the biggest fintech companies in the U.S.

How to identify lower-risk borrowers? An important factor is your major. Consider, for example, two graduates, one of whom majored in East Asian Cultures, and the other graduate had an accounting major. Which graduate will do better on average? That explains why SoFi offers competitive interest rates on medical and dental student loan refinancing.

However, keep in mind that if you refinance your federal student loan through any private lenders, including FinTech companies, you will lose eligibility for government assistance programs, which includes the ability to enroll in an income-driven repayment plan and the variety of deferments such as the federal student loan payment freeze that have been lasting for nearly two years.

In conclusion, if you don’t benefit from no risk-based pricing federal student loan offers, you may consider refinancing your federal student loans through FinTech lenders. But then again, by doing so, you will give up income-driven repayment and various deferment options.

Wei Zhang

Assistant Professor of Finance