Tax filing season is finally in the rearview mirror. Before we get too far down the road this year, I wanted to address the issue of managing your paycheck tax withholding. I have had so many questions from friends and family about how to fix their payroll withholding. Some were having to pay in more taxes for the first time in their life. Others were getting a huge refund due to some of the new tax credits.

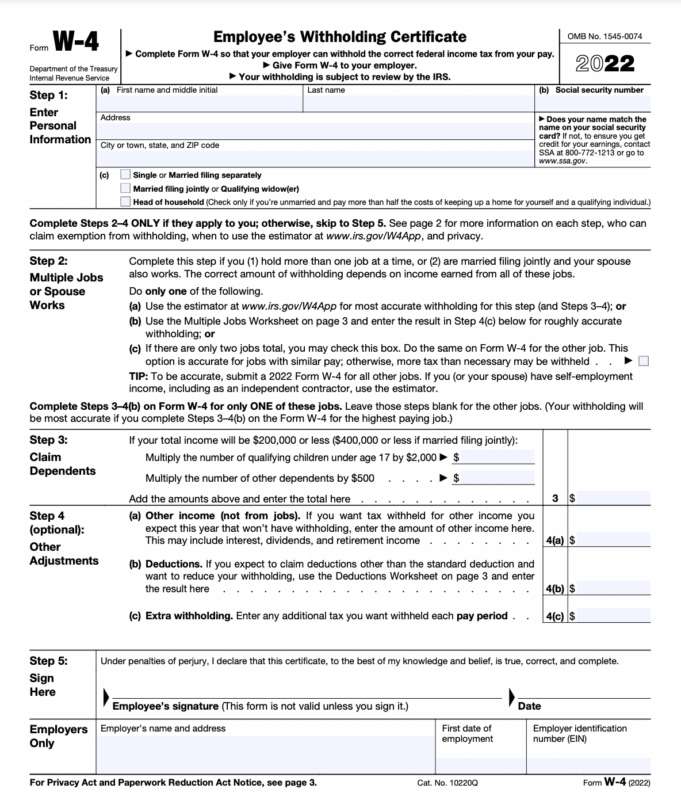

In most of the situations, the amount of the federal tax withholding is the culprit. The fix is to file a new W-4 form with your employer in order to instruct them how much tax you want withheld from your paycheck.

A Little Background

The W-4 form (Employee Withholding Certificate) was totally revised for the 2020 tax year. The catalyst for the major change was the new tax bill that overhauled the tax brackets along with the standard deduction and associated qualifying dependent deduction.

In the past, the basic premise to filling out the W-4 was to select your filing status (single, married, etc.) and then the number of your qualifying dependents. There was a formal calculation worksheet associated with the form, but for the most part, people tended to adjust their withholding amount by changing the number of dependent allowances.

For working couples, the accountant’s trick was to have one spouse claim the married status along with all of the dependents, and the other spouse to select the married but filing single status with no dependents.

Mastering the New Form W-4

The new W-4 form at first glance feels like you are filling out your annual tax return. Ok, so maybe I am exaggerating a bit, but it certainly requires more than just a casual read through the instructions in order to grasp it!

As with prior versions of the form, you can just fill out the bare minimum (step #1 on the new form) which includes your personal information and your filing status. But, this is where the problems of incorrect tax withholding can begin.

The form divides into five steps: (1) Personal Information and filing status; (2) Coordinating multiple income streams from jobs; (3) Dependent tax credits; (4) Other income, deductions, and a manual adjustment; and finally, step number (5) sign and date.

Highlighting step #2(c), if you have a second job, or your spouse has a job making within a similar pay range, then you can simply check the box on line (c). Your spouse will have to do the same thing on their job’s W-4 form. In the background, this will help to allocate the standard deduction and better estimate the tax brackets for your withholding.

Another key to manage your paycheck tax withholding is in step #3. This is where you estimate what your dependent tax credits will be for the year. These credits are dollar for dollar offsets against taxes. They can have a huge impact on the estimate to be withheld for your annual taxes out of each paycheck.

A Deeper Dive

Let’s do a deeper dive into a couple of the W-4 steps for a moment. Remember step #2. It’s where you address having multiple jobs for you and/or your spouse’s employment. I outlined one of the options contained in this step above, but there are two more choices you have in estimating your tax withholding.

One of those choices, step #2(a), involves using a relatively new IRS calculator that details out the most accurate estimate for your tax calculation when there are multiple jobs involved. Spoiler alert – this is a more comprehensive option involving some additional information from your current paystubs and prior tax return.

Another choice is in step #2(b), which is more of a manual option using a worksheet that comes with the W-4.

Finally, there is step #4. Here is where you can add in additional expected income, like interest and dividends. You can also use a worksheet to find some common tax deductions that will help lower your overall tax bill. As I stated above, it feels somewhat like you’re doing your tax return in these more involved options.

A Shortcut – Kind of

Ok, so everyone likes a shortcut. Step #4(c) has it, but only in one direction. If you owe more taxes and need to withhold more out of each paycheck, here is your easy step.

You just finished filing your current year’s tax return, and you owed taxes. Simply take the amount you had to pay in with your return and divide it by the number of pay periods you have remaining in the current year. Fill that amount in box 4(c). Your employer will withhold this additional amount on each of your remaining checks.

So, I said it’s “kind of” a shortcut. My disclaimer here is that it produces a very rough tax estimate, and it needs to be adjusted each year. It’s only intended to soften the year-end surprise if you are under-withholding. The downfall of the shortcut is that it assumes the current year is going to be pretty much like last year was. That isn’t always the case as we all know!

W-4 Privacy Issues

The W-4 form does come with some privacy issues that I have some concerns about.

First off, you may be disclosing that you have another job to your current employer. That may not be an issue, but it could for some people depending on their job. Maybe it’s a side-business that you really don’t want to reveal.

In addition, you may not want to disclose the additional income you make from investments like interest and dividends. As an example, you might feel it would hurt your case when you ask for a raise.

Depending on the size of your company, your immediate supervisor probably will never see your form, but do be aware of the possible privacy issue involved in what you disclose on your W-4.

If you wanted to avoid this issue, I would suggest you consider just making an additional tax estimate payment on a quarterly basis outside of your payroll withholding. You might need to get some help from a professional tax preparer, but that may be best especially if your side-hustle exposes you to self-employment tax.

Conclusion

With inflation driving up food and gas costs, everyone could use a little more in their take-home pay. With just a little investment of your time, managing your paycheck tax withholding can be a rewarding proposition!

To learn more about the various business degrees offered at the West Texas A & M University Paul and Virginia Engler College of Business, click here.

David W Clark, MPA, CPA

Instructor of Accounting & Healthcare Management